Precision in Accounting: A Comprehensive Guide on How to Calculate Predetermined Overhead Rate

Introduction

In the realm of cost accounting, businesses rely on various metrics to allocate overhead costs to their products or services accurately. The predetermined overhead rate is a crucial tool in this process, enabling organizations to estimate and apply indirect costs to units of production. This comprehensive guide delves into the intricacies of calculating the predetermined overhead rate, providing insights into its significance, formula, factors influencing its determination, and practical applications.

Section 1: Understanding the Predetermined Overhead Rate

1.1 Significance of the Predetermined Overhead Rate

The predetermined overhead rate plays a pivotal role in cost accounting by facilitating the allocation of indirect costs to products or services. It serves as a predetermined benchmark for applying overhead costs, providing a systematic and standardized approach to distributing these expenses across various production units.

1.2 Definition and Formula

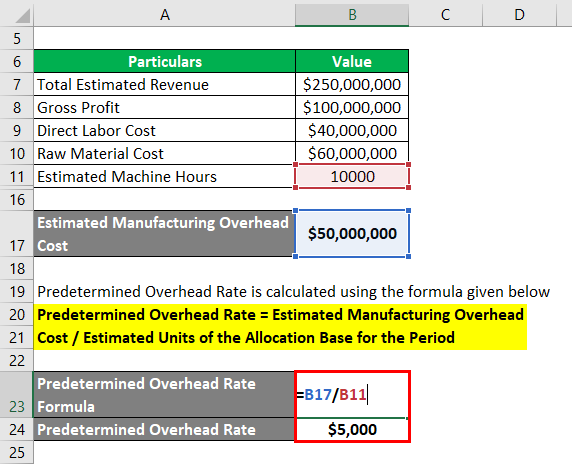

The predetermined overhead rate is defined as the estimated indirect costs allocated to each unit of production based on a predetermined metric. The formula for calculating the predetermined overhead rate is:

Predetermined \, Overhead \, Rate = \frac{Estimated \, Overhead \, Costs}{Estimated \, Activity \, Base}PredeterminedOverheadRate=EstimatedActivityBaseEstimatedOverheadCosts

This rate is applied to actual production levels during a specific accounting period.

Section 2: Calculating the Predetermined Overhead Rate

2.1 Identify Estimated Overhead Costs

To calculate the predetermined overhead rate, begin by estimating the total overhead costs expected for the upcoming accounting period. This includes expenses such as rent, utilities, maintenance, and indirect labor.

2.2 Determine the Estimated Activity Base

The activity base is a metric used to allocate overhead costs and can vary depending on the nature of the business. Common activity bases include machine hours, labor hours, or units produced. Choose an activity base that is closely correlated with the incurrence of overhead costs in the production process.

2.3 Apply the Formula

Using the formula mentioned earlier, divide the estimated overhead costs by the estimated activity base:

Predetermined \, Overhead \, Rate = \frac{Estimated \, Overhead \, Costs}{Estimated \, Activity \, Base}PredeterminedOverheadRate=EstimatedActivityBaseEstimatedOverheadCosts

This calculation yields the predetermined overhead rate per unit of the chosen activity base.

Section 3: Factors Influencing Predetermined Overhead Rate

3.1 Historical Data Analysis

Examining historical data on overhead costs and activity levels provides valuable insights into trends and patterns. Analyzing past performance helps in making informed estimates for the upcoming accounting period.

3.2 Industry Benchmarks

Benchmarking against industry standards and competitors’ practices can offer a reference point for estimating overhead costs. However, businesses should consider their unique circumstances and adjust benchmarks accordingly.

3.3 Technological Advances

Advancements in technology can impact production processes, leading to changes in activity levels and, consequently, overhead costs. Businesses should factor in technological advancements when estimating the predetermined overhead rate.

3.4 Economic Conditions

Fluctuations in economic conditions can influence the cost of resources and services. A thorough analysis of economic indicators helps in making realistic estimates of overhead costs.

3.5 Changes in Production Volume

Variations in production volume directly affect overhead costs. Businesses experiencing changes in production levels should adjust their estimates accordingly to reflect the impact on the predetermined overhead rate.

Section 4: Practical Applications

4.1 Product Costing

The predetermined overhead rate is a fundamental component of product costing. By applying this rate to the actual production volume, businesses can accurately allocate indirect costs to individual products, aiding in the determination of product profitability.

4.2 Budgeting and Planning

Incorporating the predetermined overhead rate into budgeting processes allows organizations to forecast overhead costs systematically. This assists in resource allocation, pricing strategies, and overall financial planning.

4.3 Performance Evaluation

Comparing the predetermined overhead rate with the actual overhead costs incurred provides a basis for performance evaluation. Variances between estimated and actual costs offer insights into the efficiency and effectiveness of the production process.

4.4 Decision-Making Support

The predetermined overhead rate serves as a valuable tool in decision-making. Whether evaluating the feasibility of a new project or assessing the impact of changes in production processes, businesses can rely on this rate to make informed decisions.

Conclusion

The ability to calculate the predetermined overhead rate accurately is a cornerstone of effective cost accounting. By estimating overhead costs based on a chosen activity base and applying this rate to actual production levels, businesses can ensure a fair and precise allocation of indirect costs. As organizations navigate the complexities of modern business environments, the predetermined overhead rate remains a strategic tool for financial planning, performance evaluation, and informed decision-making. Embracing a systematic approach to calculating this rate contributes to the overall efficiency and financial health of an organization, reinforcing its ability to adapt and thrive in dynamic markets.