How to Budget in QuickBooks: A Comprehensive Guide

Budgeting is a crucial aspect of financial planning that allows businesses to set financial goals, allocate resources effectively, and monitor financial performance. QuickBooks provides robust tools for creating, managing, and analyzing budgets, making it easier for businesses to stay on track financially. This comprehensive guide will walk you through the process of budgeting in QuickBooks, including initial setup, best practices, and advanced tips for effective budget management.

Why Budget in QuickBooks?

Budgeting in QuickBooks offers several advantages:

- Financial Control: Helps you manage your finances more effectively by setting spending limits and financial targets.

- Performance Monitoring: Allows you to compare actual performance against budgeted figures, identifying areas of improvement.

- Resource Allocation: Ensures that resources are allocated efficiently, preventing overspending and optimizing cash flow.

- Informed Decision-Making: Provides insights into financial performance, aiding in strategic decision-making.

Setting Up Budgets in QuickBooks

Before you can start managing your budget in QuickBooks, you need to set up the necessary components. Here’s a step-by-step guide to setting up budgets in QuickBooks Online and QuickBooks Desktop.

Setting Up Budgets in QuickBooks Online

Step 1: Access the Budgeting Tool

- Open QuickBooks Online: Log in to your QuickBooks Online account.

- Navigate to the Budgeting Tool: Go to the left-hand navigation menu and select “Settings” (the gear icon). Under “Tools,” select “Budgeting.”

Step 2: Create a New Budget

- Create New Budget: Click on “Add budget.”

- Name Your Budget: Enter a name for your budget (e.g., “2024 Budget”).

- Set the Fiscal Year: Choose the fiscal year for the budget.

- Interval: Select the budget interval (monthly, quarterly, or yearly).

- Subdivide by: If needed, choose to subdivide by customer, class, or location for more detailed budgeting.

- Save and Continue: Click “Next” to proceed.

Step 3: Enter Budget Details

- Income and Expenses: Enter the budgeted amounts for each income and expense category. You can input amounts for each month or use the “Copy Across” feature to apply the same amount across multiple periods.

- Adjustments: Use the “Adjust” button to make percentage-based adjustments to multiple categories simultaneously.

- Save the Budget: Once you’ve entered all the details, click “Save” to create the budget.

Setting Up Budgets in QuickBooks Desktop

Step 1: Access the Budgeting Tool

- Open QuickBooks Desktop: Launch QuickBooks Desktop and open your company file.

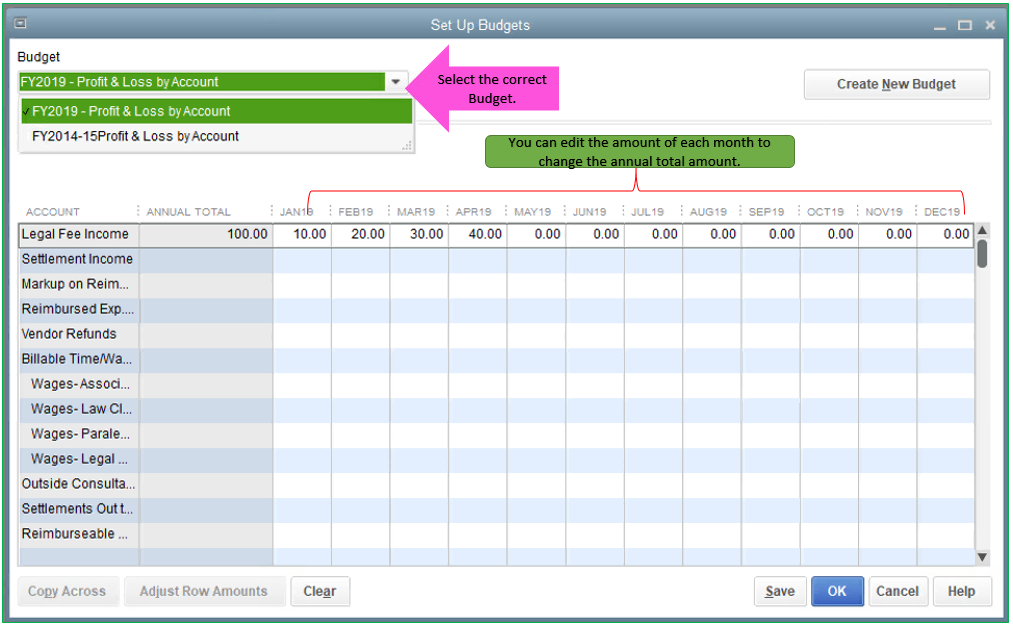

- Navigate to the Budgeting Tool: Go to the “Company” menu and select “Planning & Budgeting,” then “Set Up Budgets.”

Step 2: Create a New Budget

- Create New Budget: In the “Set Up Budgets” window, click “Create New Budget.”

- Select Fiscal Year: Choose the fiscal year for the budget.

- Budget Type: Select the budget type (Profit and Loss, Balance Sheet, etc.). Most businesses use Profit and Loss for budgeting.

- Additional Criteria: Choose whether to create the budget by customeror class if needed.

- Next: Click “Next” to proceed.

Step 3: Enter Budget Details

- Income and Expenses: Enter the budgeted amounts for each income and expense account. You can input amounts for each month or use the “Copy Across” feature to apply the same amount across multiple periods.

- Adjustments: Use the “Adjust Row Amounts” option to make percentage-based adjustments to multiple categories simultaneously.

- Save the Budget: Once you’ve entered all the details, click “Finish” to create the budget.

Managing and Analyzing Budgets in QuickBooks

Once your budget is set up, it’s important to regularly manage and analyze it to ensure financial health and performance. QuickBooks offers various tools and reports to help you do this.

Reviewing Budget vs. Actual Reports

Comparing your actual financial performance against your budgeted amounts is crucial for identifying variances and making informed decisions.

Step 1: Access Budget Reports

- QuickBooks Online: Go to the “Reports” menu and search for “Budget vs. Actuals” under the “Business overview” section.

- QuickBooks Desktop: Go to the “Reports” menu, select “Budgets & Forecasts,” and choose “Budget vs. Actual.”

Step 2: Customize the Report

- Customize Report: Use the customization options to set the date range, columns, and filters. You can also add or remove specific accounts as needed.

- Run Report: Click “Run Report” or “Refresh” to generate the report.

Step 3: Analyze Variances

- Review Variances: Compare the actual amounts to the budgeted amounts to identify variances. Positive variances indicate better-than-expected performance, while negative variances highlight areas that may need attention.

- Investigate Causes: Investigate the reasons behind significant variances to understand the underlying factors. This can involve reviewing specific transactions, talking to department heads, or analyzing market conditions.

Adjusting Budgets

Budgets are not set in stone. You may need to adjust your budget throughout the year based on actual performance and changing circumstances.

Step 1: Access the Budget

- QuickBooks Online: Go to the “Settings” (gear icon), select “Budgeting,” and choose the budget you want to adjust.

- QuickBooks Desktop: Go to the “Company” menu, select “Planning & Budgeting,” then “Set Up Budgets,” and choose the budget you want to adjust.

Step 2: Make Adjustments

- Adjust Amounts: Modify the budgeted amounts as needed. This can involve increasing or decreasing amounts for specific categories based on actual performance and new projections.

- Save Adjustments: Once you’ve made the necessary adjustments, save the updated budget.

Best Practices for Budgeting in QuickBooks

To ensure effective budgeting in QuickBooks, follow these best practices:

Set Realistic Goals

- Realistic Projections: Base your budget on realistic projections and historical data. Overly optimistic or pessimistic budgets can lead to poor financial planning.

- Consult Stakeholders: Involve key stakeholders in the budgeting process to ensure that the budget reflects the needs and expectations of different departments.

Regularly Review and Update

- Monthly Reviews: Conduct monthly reviews of your budget vs. actual performance to stay on top of variances and make timely adjustments.

- Flexible Budgeting: Be flexible and willing to update your budget as circumstances change, such as market conditions, new business opportunities, or unexpected expenses.

Use Technology

- Automation Tools: Utilize QuickBooks’ automation tools, such as automatic transaction categorization and reporting, to streamline the budgeting process.

- Third-Party Apps: Integrate third-party budgeting and forecasting apps with QuickBooks for advanced features and enhanced functionality.

Communicate and Educate

- Transparent Communication: Maintain transparent communication with your team about budget goals, expectations, and performance. This helps create a sense of accountability and ownership.

- Training: Provide training to relevant staff on how to use QuickBooks for budgeting and financial management.

Advanced Budgeting Tips

For more advanced budgeting in QuickBooks, consider these additional tips:

Class and Location Tracking

- Class Tracking: Use class tracking to create budgets for different departments, locations, or business segments. This allows for more detailed budgeting and performance analysis.

- Location Tracking: Similarly, use location tracking to create budgets for different physical locations or business units.

Forecasting

- Forecasting Tools: Utilize QuickBooks’ forecasting tools to create financial forecasts based on historical data and future projections. This can help you anticipate financial performance and plan accordingly.

- Scenario Planning: Conduct scenario planning by creating multiple budget scenarios (e.g., best case, worst case, most likely case) to prepare for different potential outcomes.

KPI Tracking

- Key Performance Indicators (KPIs): Track KPIs related to your budget, such as revenue growth, profit margins, and expense ratios. Use these KPIs to measure performance and make data-driven decisions.

- Dashboard: Set up a dashboard in QuickBooks to monitor your KPIs and budget performance in real time.

Troubleshooting Common Budgeting Issues

Despite careful planning, you may encounter some common budgeting issues. Here are solutions to frequent problems:

Budget Overruns

- Identify Causes: Review budget vs. actual reports to identify categories where spending has exceeded the budget. Investigate the causes of overruns.

- Adjust Budget: Adjust your budget to account for necessary overruns, and implement cost-control measures to prevent future overruns.

Inaccurate Projections

- Review Historical Data: Ensure that your budget projections are based on accurate and comprehensive historical data. Adjust projections as needed based on past performance.

- Consult Experts: Consult financial experts or industry benchmarks to improve the accuracy of your projections.

Untracked Expenses

- Regular Reviews: Conduct regular reviews of your expenses to ensure all transactions are categorized and tracked correctly.

- Automate Tracking: Use QuickBooks’ automation features to minimize the risk of untracked expenses.